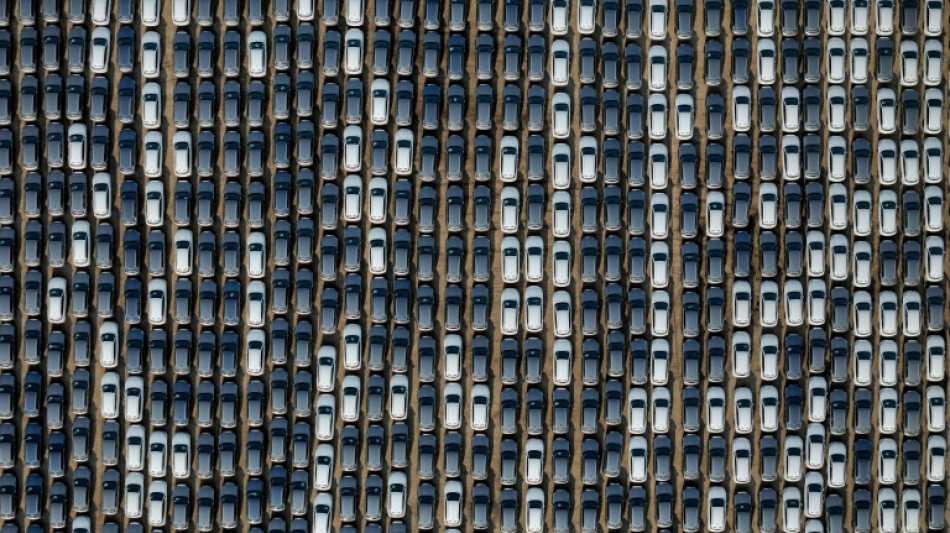

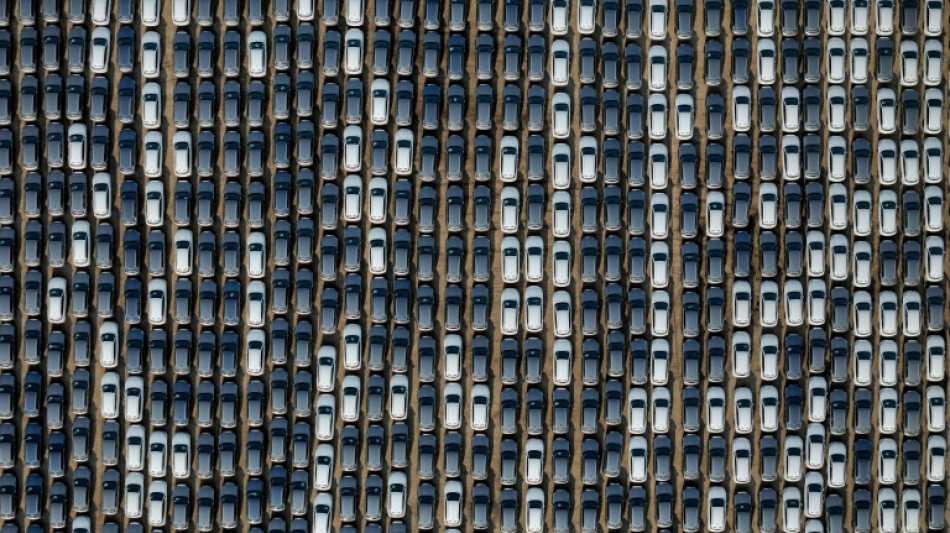

China's electric and hybrid vehicle sales jump 40.7% in 2024

Sales of electric and hybrid vehicles jumped more than 40 percent in China last year, as demand for new energy models continues to surge and the sector remains entrenched in a gruelling price war.

The Chinese electric vehicle market has witnessed explosive growth in recent years, driven in part by generous subsidies from Beijing.

But the world's largest automotive market has also seen fierce competition among domestic car manufacturers as a consumption slowdown fuels a price war that is weighing on profitability

In 2024, almost 11 million new energy vehicles (NEVs) were sold, a year-on-year increase of 40.7 percent, the China Passenger Car Association (CPCA) said Thursday.

NEVs accounted for nearly half -- 47.6 percent -- of all retail sales last year, the association said.

By comparison, such vehicles accounted for just 22.6 percent of sales in the European market in November, according to the European Automobile Manufacturers' Association.

In China, NEV sales surpassed 1.3 million units in December, CPCA data showed, up 37.5 percent year-on-year and representing the fifth consecutive month of sales of more than one million.

Beyond just NEVs, the total number of vehicles sold last year in the Chinese market swelled 5.5 percent, reaching nearly 22.9 million units, the CPCA said.

For EV companies, the price war is likely to carry on in the new year, CPCA secretary general Cui Dongshu said during a Thursday press conference.

More than 200 car models saw price cuts last year, compared to 148 in 2023, Cui added.

BYD has emerged as a clear leader in the Chinese market -- the Shenzhen-based firm sold more than four million vehicles globally in 2024.

- Bleak overseas market -

While BYD occupies roughly one third of the Chinese market, the situation is bleaker overseas, where various governments have hiked customs duties on vehicle imports from the country.

In December, sales in foreign markets accounted for just 12 percent of BYD's overall sales, according to the company's figures.

"We are now experiencing significant pressure on exports," Cui said Thursday, adding that Chinese NEV sales are "currently being suppressed by the European Union".

The European Union has said that extensive state support by Beijing for its domestic carmakers has led to unfair competition, with an investigation by the bloc finding that subsidies were undercutting local competitors.

Foreign automotive giants, on the other hand, are battling against slumping sales in the world's second-largest economy.

BYD's quarterly revenue surpassed global rival Tesla's for the first time during the third quarter last year.

F.Gionfriddo--LDdC